A 35-year-old Malaysian man was arrested from the Woodlands checkpoint while entering Singapore on Tuesday, June 19 after immigration officers found more than 6,800 sachets of chewing tobacco, which he was carrying for smuggling purpose.

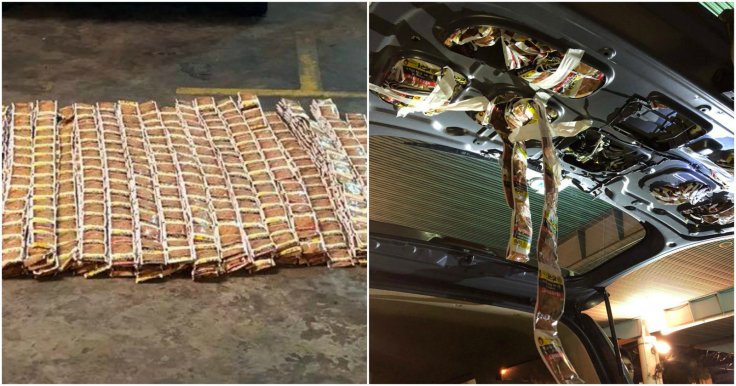

The Immigration and Checkpoints Authority (ICA) stated on their Facebook page that one of their officers noticed that the alleged smuggler was nervous and avoiding eye contact with the officials. Later, when the immigration officers suspected that something was wrong with that man, they conducted a search operation and found a huge amount of chewing tobacco, hidden in modified compartments of the car.

The sachets of chewing tobacco were secretly kept under the floor mat of the front passenger seat, inside the rear boot and on the door panels of the car. After the rescue, the car of the unnamed man was seized and officers arrested the man due to the customs offence. In the Facebook post, Which was published on Wednesday night, the ICA said that the Health Sciences Authority is currently investigating the smuggling case.

As per the Singapore Customs Act, usually, an offender may "settle customs offences by an out-of-court composition sum or prosecution in court. The penalty for a customs offence is a composition sum of up to S$5000, or prosecution in court, depending on the severity of the offence."

For the offenders, who were caught in the checkpoints, may be offered the following composition amounts:

| Type of offence | Composition Amount |

| Failure to declare or making an incorrect declaration of cigarettes | 1st offence: S$200 per packet or per 20 sticks or part thereof2nd offence: S$500 per packet or per 20 sticks or part thereof3rd offence: S$800 per packet or per 20 sticks of part thereof |

| Failure to declare or making an incorrect declaration of dutiable goods other than cigarettes | 1st offence: 10 times the duty amount2nd offence: 15 times the duty amount3rd offence: 20 times the duty amountSubject to a minimum of S$50 |

| Failure to declare or making an incorrect declaration of non-dutiable goods | 10 times the Goods and Services Tax (GST) amount subject to a minimum of S$50 |

| Leaving Singapore in a Singapore-registered motor vehicle with less than three-quarter tank full of motor fuelThis applies to petrol, CNG and petrol-CNG supply tanks. | 1st offence: S$1002nd offence: S$3003rd offence: S$500The driver must turn back to Singapore to fill the fuel supply tank to three-quarter tank full before he is allowed to leave Singapore with the motor vehicle. The driver will be charged in court if the fuel gauge of his motor vehicle has tampered. |