Singapore's private home prices bounced to a five-year high in the second quarter after slipping in the prior two quarters in the face of property curbs, underlining the resilience of the city-state's real estate sector widely seen as a safe-haven.

The private residential property index increased 1.3 percent to 150.5 points in the second quarter, from 148.6 points in the first quarter, according to flash estimates from the Urban Redevelopment Authority. The index was at its highest since the first quarter of 2014.

Private home prices had fallen 0.7 percent in the first quarter, a second consecutive fall, following a 0.1 percent decrease in October-December.

"Underlying demand is still very resilient despite the cooling measures," said Christine Li, head of Singapore and Southeast Asia research at Cushman and Wakefield.

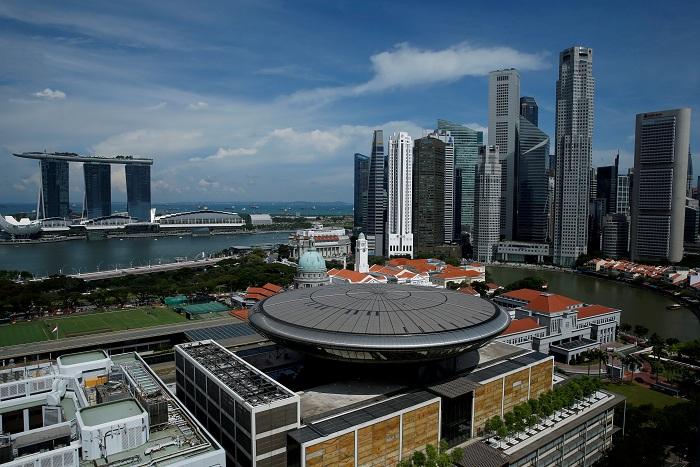

Li said the rebound in prices showed that investors remain positive on the long-term prospects of the residential market in Singapore, an international financial hub, despite the uncertainty caused by the U.S.-China trade tensions.

Demand could also have been boosted by owners looking for replacement homes after selling their apartments to property companies for redevelopment.

Moreover, Li said developers paid large premiums to acquire land in the previous two years, giving them less flexibility to lower prices.

The Singapore government intensified property curbs last July, after a 9.1 percent annual increase in home prices and as developers paid record amounts to buy land.

When asked last week about possible changes to housing market policies, Singapore's central bank managing director, Ravi Menon, said he did not see "a need to shift gears significantly" since existing policies were showing signs of tempering market enthusiasm without risking a sell-off.