Digital technology app Google Pay has made money transactions easy as paying to a friend to paying for business deals, the payments will be swift and smooth now. Using digital transaction apps, which solved half of the regular waiting time in queues for withdrawing and depositing money, Google Pay is taking it a step further with the a new feature called the 'fingerprint authentication' or 'face unlock' feature, which allows users to make their transactions faster than before.

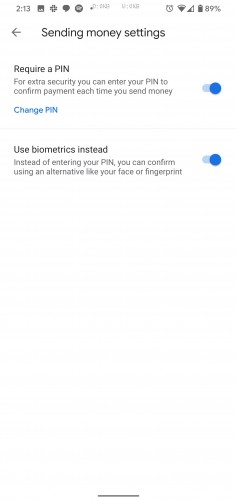

Earlier users had to access the app using a PIN lock. Now, this new feature will make the payments quicker with a tap of the finger or face authentication, which can be used in conjunction with the PIN authentication feature for more security. This feature rolls out with version 2.100 and made available for all the Android 10 users. As per the Android sources, Google Pay might bring this latest feature to Android 9 users as well in the future but for now there isn't any update about it.

This current feature works only for sending money but not for NFC payments. One needs to use the same traditional unlocking method to proceed with the NFC payments. Otherwise, Google Pay's latest feature will help users who do bulk transactions via the app. Not only that, it keeps the security feature in tact by not allowing any third-party user access it.

Google Pay Safety Issue:

Unless you are caught in an unlikely situation of coercion or mugging, Google Pay remains secure to its users with the these features. Since no payment system is completely secure anywhere, users should take the following precautions:

-- If your phone is lost or stolen, immediately use the "Find My Device" feature and lock, or erase your information.

-- Never leave your phone unlocked, it can be used by others to make purchases, though they can't directly access your financial information.

-- Send money through Google Pay to people or businesses you know, don't share it for purchases on public online forums. If you have to use, prefer payment option in person after receiving the item.