While some present these functionalities as the use cases of smart-contract platforms, let's analyze the ecosystem in place and take advantage of it to discover together the principle of decentralized finance.

Their objective is to offer different financial services that are decentralized and accessible to all. It will, therefore, be a question of the tokenisation of our physical assets, coupled with the functionalities offered by smart contracts. Some consider that many cases of use are available to users.

Decentralised finance and its definitions

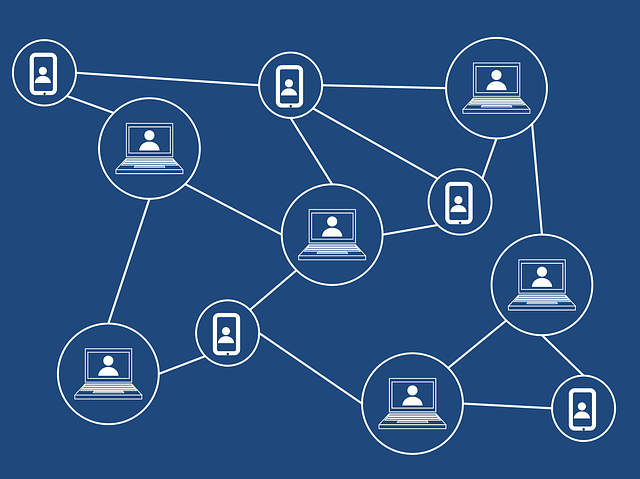

The DEFI is therefore intended to be a financial ecosystem without control bodies which is completely free of use. Ideally, and even if the situation is necessarily different in reality, the goal is to break down barriers to entry for users.

Since many people are not banked but have access to the Internet, DEFI fans propose to provide them with the same banking services, without the bank. The main strength of this new finance is precisely the synergy between its players. While the Dai, for example, which is a decentralized stablecoin might seem anecdotal, it is proving to be the cornerstone of other major ecosystem projects.

DEFI services make loan realization in a few clicks

If you want to make a bank loan, you will have to build a bank file or go through a broker. Lending money is even more complex and is often limited to loans between relatives or takes the structured form of an investment in a project. On the contrary, by using DEFI services, the realization of a loan or a loan in cryptocurrencies is done in a few clicks.

Most applications of decentralized loans operate in the same way. There is no user rating or transaction history, yet unconditional lending is not an option. That is why the protocols use the guarantee principle to make loans.

For each amount borrowed in cryptocurrency, you will need to put in a larger collateral consisting of cryptocurrency. The order of magnitude of the guarantee usually oscillates between 100% and 150% of the loan. Platforms have different ways of connecting borrowers and creditors. This can be direct peer-to-peer, that is, the two parties interact directly in the manner of an order book.

However, liquidity pools have also developed, you deposit the funds there so that they are pooled and offered to potential borrowers. If your borrowing capacity goes down, as the value of your guarantee goes down, you're in a wind-up situation. Your guarantee will then be put up for sale at a lower unit price than the market.

By projecting, we can imagine that the use of DEFI in our daily life will facilitate our relationship with finance. We are still a long way from that, but the market is indeed evolving very quickly.