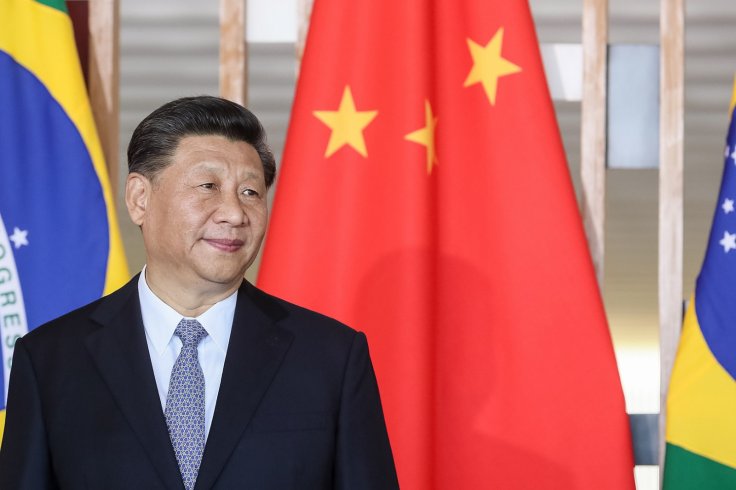

China's all-powerful president Xi Jinping had calculated that the IPO of Jack Ma's Ant Group would have a host of unwelcome beneficiaries besides adding stress to the financial system. The Wall Street Journal reported on Tuesday that these were the reasons behind the Chinese Communist Party's decision to block the initial public offering of the company.

By the end of December last year, there were reports that the Chinese government was planning to nationalize Alibaba, Jack Ma's flagship company, as well as Ant Group.

The disappearance of Jack Ma followed by the blocking of the IPO of his holding company Ant Group followed, kicking off reports of Xi Jinping's highhandedness and direct muzzling of the globally renowned billionaire.

Xi's Motives Were Clear

At the beginning of the new year, speculation that Jack Ma had gone missing, and that he may have been arrested by the government, came to the fore. These were followed by reports of his disappearance and stories of his possible arrest and even death. However, in the third week of January, reports from China said Ma was seen in public after months. The news took the shares of the company up more than 8 per cent in Hong Kong.

The WSJ report now says that Xi's motives were clear -- he was certain that Jack Ma was undercutting his mission to strengthen financial oversight and regulation. Xi was furious that Ma criticized his regulatory policies and went ahead with the IPO, which would add risks to the financial system.

Another important reason behind Xi's tough call was that he realized that the IPO would have unintended beneficiaries. Ant Group's complex ownership structure meant that a host of people in Beijing's crosshairs would have gained immensely from what would have been the world's largest IPO.

Coterie of Well-Connected Power Players

The potential beneficiaries of the IPO included "a coterie of well-connected Chinese power players, including some with links to political families that represent a potential challenge to President Xi and his inner circle," the journal reported. "Those individuals, along with Mr. Ma and the company's top managers, stood to pocket billions of dollars from a listing that would have valued the company at more than $300 billion," the report added.

Earlier this month, Bloomberg reported that Jack Ma's Ant Group had reached an agreement with Chinese regulators to thrash out a restructuring plan. As per the purported agreement, the fintech giant will be turned into a financial holding company.

Under the plan, all of Ant's businesses will be transferred onto a holding company. This includes Ant's technology offerings in sectors like blockchain and food-delivery, the report said.