Moma Protocol, a solution which aims to solve liquidity, scalability, and speculative needs in the red-hot defi lending markets, has raised $2.25 million in a round led by Fundamental Labs and SevenX Ventures.

A common issue within burgeoning defi projects is the lack of liquidity which can impair the efficacy of protocols until liquidity pools are rebalanced, putting user profits at risk. Moma plans to achieve "infinite liquidity" through lending the long tail of defi assets. The innovative and hyper-scalable idea has garnered plenty of support from blockchain investors.

The proposal was extremely well-received to say the least, with the latest private funding round tallying $2.25 million. Blockchain firms included in the funding comprise AU21 Capital, Blocksync Ventures, building blocks, Coins Group, Consensus Investment, DFG Capital, FBG Capital, Finlink Capital, Lotus Capital, Magnus Capital, and Moonrock Capital.

A SevenX Ventures representative commented on the successful raise: "As the most important foundation pillar of defi architecture – the lending agreement – Moma has made a unique and permissionless innovation here, which greatly enriches the diversity of the market. It has huge potential to become a scalable platform covering both the mainstream and long tail digital assets."

Moma Is Serious About DeFi

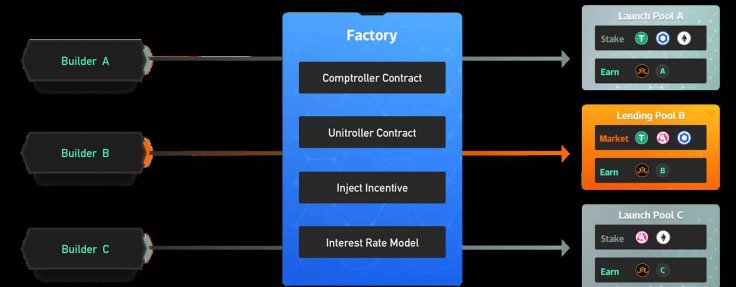

Moma Protocol is headed by CEO Ocean Liao, who has masterminded projects like TokenUp wallet, Gravity, and LiChang. In fact, Moma was initially incubated by Liao's user-generated content platform app, LiChang. After inception, Moma created a smart contract "factory" which allows for the production and management of custom Launch Pools and Lending Pools.

The idea behind creating these pools is to expand defi opportunities and increase the amount of control users have with their money. Moma states that as a Pool Builder, a user can customize the type of crypto assets and other parameters independently, and create their own Launch Pool and Lending Pool which they can fully operate by themselves to generate profits.

The idea is that with unlimited pools that can be generated, they can fit the needs of lending long tail assets. Paired with these custom pools are incorporated risk management factors including a crypto asset risk rating database, a whistleblower function for those who stake the MOMA token, a reserve pool to cover losses and, as a further backstop, a staking management pool which allows MOMA tokens to be mobilized to cover losses.

Customization Doesn't Stop There

According to CEO Ocean Liao: "I believe that the goal that Moma Protocol wants to achieve is to create an expandable, scalable and flexible infrastructure for the defi world in 5-10 years, in a way that everyone can freely participate. I am optimistic about the defi ecology and the lending market, and I am happy to be able to drive Moma Protocol to explore the future with the infinite liquidity-generating factory model that fascinates me the most."

Liao clearly believes in flexible infrastructure, as there are not only custom pools, but custom yield aggregators which will allow users to automate their defi processes. Price Feed is another function in which Moma will provide a unique oracle system that combines the mechanisms of Committee Price Feed and Decentralized Price Feed, allowing users more autonomy over price setting.

With a lot of moving parts, it's important to knock one task off the roadmap at a time. Next up for Moma is the issuance of its governance token, commencing system testing and deployment on the Ethereum mainnet.