Singapore business tycoon Forrest Li lost more than $25 billion in a market crash and dropped down from the list of the world's top 500 richest people. The market sell-off, which happened earlier this month, even impacted well-known billionaires of the tech industry.

Founder of Sea Limited, a global consumer internet company, Li was the richest person in Singapore until just a few months ago with a $32 billion fortune. With the rise of strong competitors such as Alibaba, Sea Ltd. is expected to face a record loss of more than $740 million in its first quarter earnings, as per the average analyst estimate compiled by Bloomberg.

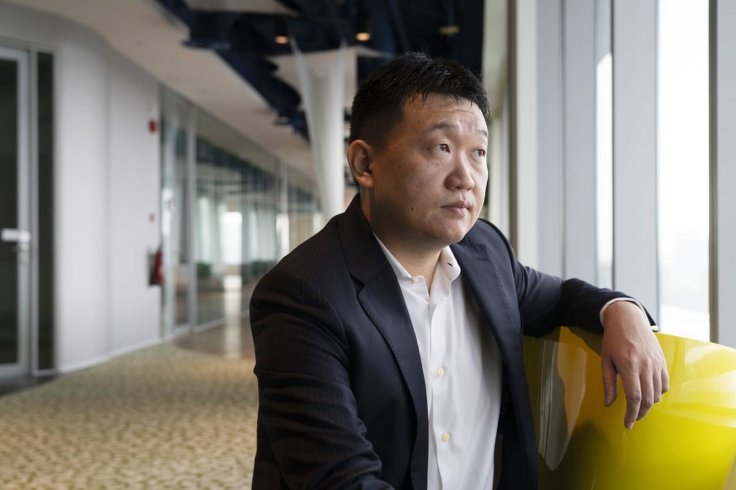

Shawn Yang, managing director of Blue Lotus Capital, an independent research firm in Hong Kong, believes that the company's main source of revenue, its e-commerce sales, might fall short of its $8.9 billion to $9.1 billion annual plan. Yang is of the opinion that the relaxation of Covid-19 induced lockdowns prompting a surge in offline shopping has ultimately resulted in Li confronting such a huge loss.

According to Financial Review, the war in Eastern Europe and higher interest rates have further contributed to the fall in the company's stock.

Prior to the valuation collapse, the Singaporean billionaire had reached out to his staff in March. In a 900-word internal memo he intimated to them about the upcoming loss. "It is a short-term pain that we must endure in order to really maximize our long-term potential," Li advised.

Out of the 38 Bloomberg analysts that observed and reviewed the two-year low in the stock decline, a majority of them still feel that Sea Ltd.'s valuation might recover soon if any improvement is detected in its prospects accompanied with a proper geographical expansion.

After recovery of 32 percent in the midst of a tech rally last week, shares have experienced a 6.7 percent drop on Monday. Experts have therefore cautioned against the current stock market volatility and its prolonged stay.

Apart from Li, the billionaire tech entrepreneurs who were negatively impacted by this market crash include, Eric Yuan Chief executive of Zoom, Jeff Bezos of Amazon and the father-son duo Ernie Garcia II and Ernie Garcia III, of Carvana among others.