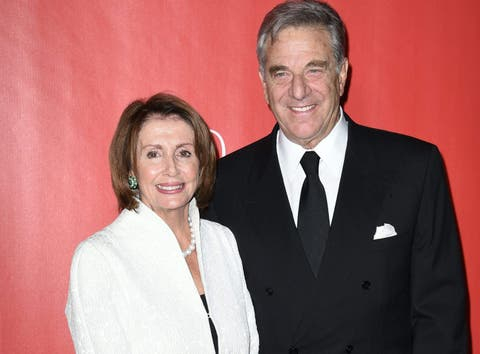

House Speaker Nancy Pelosi's husband has bought chips stocks worth millions of dollars days before a crucial vote on chip subsidy. Paul Pelosi bought 20,000 shares of top semiconductor company Nivida, according to the details that emerged from disclosure reports of Nancy.

Senate on Tuesday could decide on a bipartisan competition bill, which will set aside $52 billion in an effort to scale up the manufacturing of domestic semiconductors.

Chip stock purchase by Paul, who bought Nivida stocks on June 17, endorses speculation that Paul could have received an insider tip about legislative information.

Paul Could Have Access to Some Insider Legislative Information

Craig Holman, a government affairs lobbyist for the left-wing think tank Public Citizen, told the Daily Caller that chip stocks purchase certainly raise the specter that Paul Pelosi could have access to some insider legislative information.

This is the reason "why there is a stock trading app that exclusively monitors Paul's trading activity" and then its followers do likewise, according to Holman.

Nancy Pelosi Would Be Aware Of Timing of Legislation

Claims are also being made that the Speaker would have known about the timing of the bill.

Expressing doubt over Paul's purchase of chip stocks, Republican South Carolina Rep. Ralph Norman stated that the "optics" of Pelosi's stock disclosure "are horrible".

Norman went on to say that obviously, Speaker Pelosi would be aware of the timing of this legislation over in the Senate.

"On the heels of that vote, for anyone in her orbit to purchase seven-figures worth of stock of a US-based chip manufacturer just reeks of impropriety," Norman told DCNF.

In June Paul was charged with two alcohol misdemeanors following his arrest over a driving collision.

Paul, who disclosed that he sold up to $250,000 worth of Apple stock and up to $5 million worth of Visa stock, is an avid stock trader and purchased more than $6 million worth of Nvidia call options in 2021, according to Daily Caller.

Read more