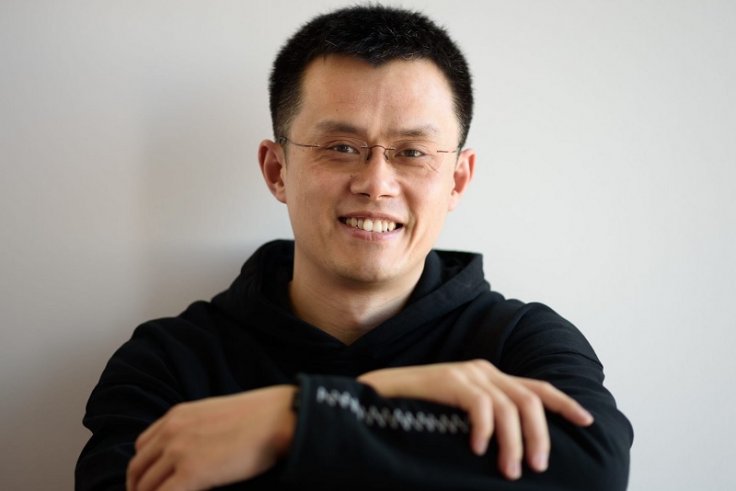

As 2022 dawned, Changpeng Zhao was riding high. In less than five years, the founder and chief executive of Binance had turned his young company into the world's largest crypto exchange, accounting for more than half the trading in the trillion-dollar market.

True, global authorities were scrutinising crypto exchanges ever-more closely. But the Chinese-born billionaire, known to staff and fans by his initials, CZ, had that covered. He told customers in a blog post in January that Binance "embraces regulations" and "has always worked collaboratively with regulators all over the world."

Behind the scenes, however, trouble loomed.

Money Laundering Probe

For at least a year before that post, the U.S. Justice Department had been pursuing a money laundering investigation into Binance, seeking extensive records on Binance's policies and the conduct of Zhao and other top executives, Reuters reported on Sept. 1. Binance called such requests a "standard process" and said it works with agencies worldwide to address their questions.

Now, new reporting by Reuters reveals fresh details about Binance's strategy for keeping regulators at arm's length and continuing disarray in its compliance programme. The reporting includes interviews with around 30 former employees, advisers and business partners and a review of thousands of company messages, emails and documents dated between 2017 and early 2022.

It shows that in 2018, Zhao approved a plan by lieutenants to "insulate" Binance from scrutiny by U.S. authorities by setting up a new American exchange. The new exchange would draw regulators' attention away from the main platform by serving as a "regulatory inquiry clearing house," according to the proposal. Executives went on to set the plan in motion, company messages show.

In public, Zhao said the new U.S. exchange – called Binance.US – was a "fully independent entity." In reality, Zhao controlled Binance.US, directing its management from abroad, according to regulatory filings from 2020, company messages and interviews with former team members. An adviser, in a message to Binance executives, described the U.S. exchange as a "de facto subsidiary."

Turmoil

This year, Binance.US's compliance operation has been in turmoil. Almost half the U.S. compliance team quit by mid-2022 after a new U.S. boss was appointed by Zhao, according to four people who worked at Binance.US. The staff left, these people said, because the new chief pushed them to register users so swiftly that they couldn't conduct proper money laundering checks.

The U.S. Department of Justice Building in Washington. The department has sought internal records on Binance's policies and the conduct of Zhao and other top executives. REUTERS/Tom BrennerThe new insights come as the Justice Department is investigating whether Binance violated the Bank Secrecy Act, which requires crypto exchanges to register with the Treasury Department and comply with anti-money laundering requirements if they conduct "substantial" business in the United States.

"The Binance structure in the U.S. raises questions about the degree to which the parent company is willing to comply with U.S. laws and regulations," said Ross Delston, an independent lawyer, former banking regulator, and expert witness on anti-money laundering issues.

In Britain, too, Binance sought ways around regulatory scrutiny, company messages show. Zhao signed off on a plan in 2020 by a Binance executive to backdate a company document to avoid a review of a Binance UK unit under new illicit finance rules.

"I am fine with it," he wrote in an exchange discussing the plan.

Reuters sought comment for this article from Zhao, Binance and Binance.US.

Binance Chief Communications Officer Patrick Hillmann said that over the past two years, Binance has "worked with global law enforcement to seize assets of some of the most prolific criminal organizations" in the world. He didn't address Reuters' detailed questions.

After this article was published, Zhao said in a blog post that he "personally rejected" the 2018 plan to insulate Binance from U.S. regulators. Binance.US was set up "based on advice from leading US law firms," he said.

Binance Response

A spokesperson for Binance.US said Reuters' questions presented a "biased narrative," providing a "distorted depiction of Binance.US based on inaccuracies, misrepresentations, and outright falsehoods that simply do not square with reality."

Binance.US was founded "with the express purpose of operating as a licensed and regulated entity in the United States," the spokesperson said. "In the last year, under current management, we have invested in talent, technology and financial resources to maintain the highest standards for compliance," substantially increasing headcount and budget. "All Binance.US users, no exceptions, go through the same rigorous screening and validation process."

The U.S. Justice and Treasury departments and Britain's regulator, the Financial Conduct Authority, declined to comment. The FCA warned consumers in June 2021 that Binance doesn't hold "any form" of permission to offer services regulated by Britain.