A strong stimulus package is needed for mainland China's economic recovery, said S&P Global Market Intelligence in a report on Tuesday.

"Mainland China's reopening should result in an economic recovery in 2023, while global economic moderation, the still weak consumer confidence and property slowdown indicate that a robust and smooth recovery requires a stronger stimulus package in the coming year," S&P Global said.

According to the report, China's consumption recovery remained soft entering January and with a high baseline in the first quarter of 2022, a continuous weakness in the first quarter of 2023 is expected.

A sharp rebound is expected in the second quarter of the current year.

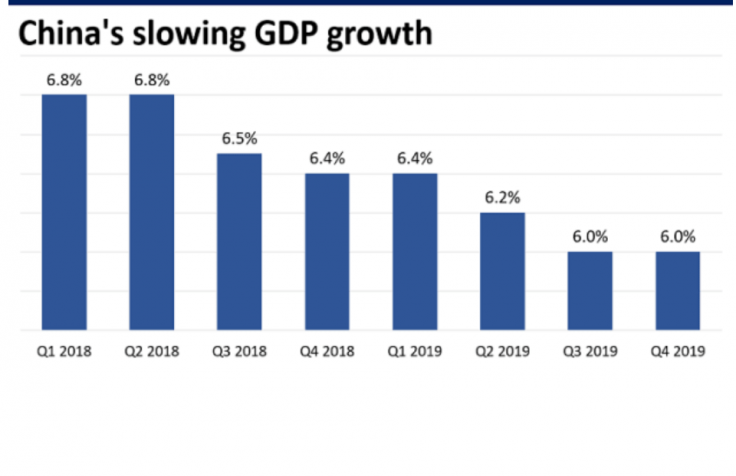

The S&P Global report said, China's 2022 real gross domestic product (GDP) growth came in at three per cent year on year (y/y), with the fourth quarter GDP slowing to 2.9 per cent y/y from 3.9 per cent y/y in the third quarter.

The Covid-outbreak resurgence that started in November and the infection waves due to the relaxed stance on the pandemic in December weakened services activities, and the decline of exports weighed on the industrial slowdown, S&P Global said.

According to the report, what's more worrying is the structural economic moderation induced by slowing urbanisation, declining labour force and real estate downturn, which could lead to a decline in potential growth. Mainland China's population recorded its first decline in 2022.

The full reopening of mainland China's borders is likely to be delayed until international restrictions against China-originated travel are dropped. Also, policies may still be adjusted dynamically based on the evolution of the virus, S&P Global said.