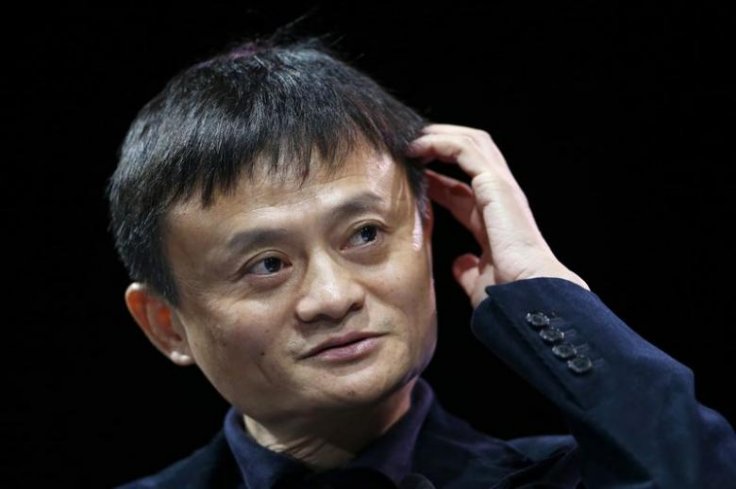

China has fined Jack Ma's Alibaba a whopping $2.75 billion (18 billion yuan ) for the violation of anti-monopoly rules and 'abusing its dominant market position'.

China's State Administration for Market Regulation also said Alibaba must overhaul its systems to ensure total internal compliance with consumer rights norms, Reuters reported.

Earlier in March it was reported that the CCP government was moving ahead to impose a $1 billion fine on his e-commerce behemoth Alibaba after months-long investigation into alleged violation of monopoly rules. it was reported that the financial punishment for Alibaba will be finalized after the measures are approved by China's top leadership.

However, the latest development shows that China's crackdown on the country's first internet billionaire is harsher than originally assessed.

According to China Communist Party mouthpiece Global Times, the fine on Alibaba amounts to as much as 4 percent of its 2019 revenue. The paper reported that China instructed Alibaba to "stop illegal activities," and accused it of abusing its market dominant position.

By the end of December last year, there were reports that the Chinese government was planning to nationalize Alibaba, Jack Ma's flagship company, as well as Ant Group. The news frenzy was kicked off after China's investigators set up an office at the Alibaba headquarters in November.

This was followed by further bad news for Jack Ma as the focus turned to his criticism of President Xi Jinping and the consequences thereof. There were speculations that Jack Mas probably detained and even that he may have been dead. The many months of absence from public life fueled the speculations even as the stock of the company running China's largest online shopping portal kept bleeding.

It was reported in February that Ant Group had reached an agreement with Chinese regulators to thrash out a restructuring plan. As per the purported agreement, the fintech giant will be turned into a financial holding company. Under the plan, all of Ant's businesses will be transferred onto a holding company. This includes Ant's technology offerings in sectors like blockchain and food-delivery, the report said.