The ugly face-off between Chinese President Xi Jinping and billionaire entrepreneur Jack Ma is set to deal a big blow to investments in the country. At a time when several foreign companies are looking at diversifying their supply sources by relocating their manufacturing facilities outside China, this recent development could lead to further uncertainties for the global investing community, several analysts said.

Analysts said that investments will be critical for the Chinese government, which has been concerned about employment generation and livelihood.

China is already struggling to find employment for its 8.74 million students who passed out this year. This is a record high number– about half a million more than 2019.

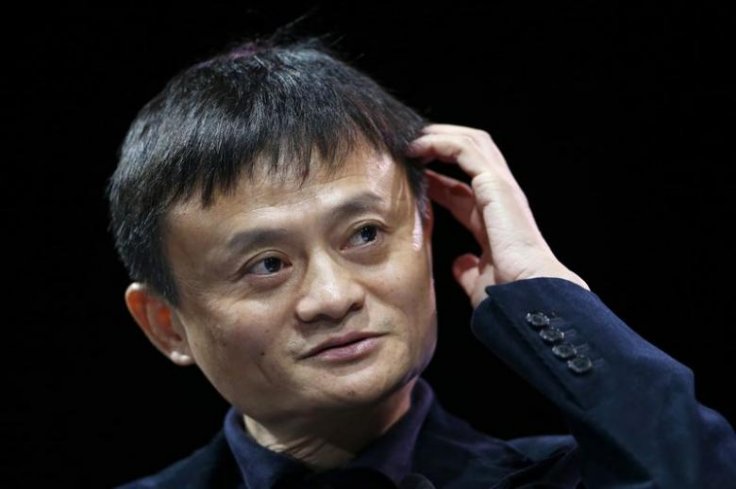

Last month, Ma's Ant Group, an affiliate company of the Chinese Alibaba Group surprised investors when it suddenly announced suspension of its initial public offering (IPO) — barely two days before it was slated to hit the market. Ma, the co-founder and former chairman of the Alibaba Group, has been China's poster boy.

"Ma has not only been an iconic figure in China but the world over. His is an incredible success story epitomising the typical rags to riches theory but now with the recent fracas between him and the authorities, things are falling apart," an analyst on condition of anonymity said.

Ma's story may impact investors' sentiments

The analyst added that unfortunately the story will not be limited to Ma and his companies but will have an encompassing impact on the entire global investment community.

"The timing of the decision showed once again that for Xi and the party, financial and political stability take precedence over ceding control of the economy — especially to a private company. In Beijing's view, allowing the IPO to go forward could effectively give Ant too much sway over the financial system, posing broader risks that could ultimately undermine the party's grip on power," the Japan Times wrote.

While the public sector has increased its hiring activities to address the problem, employment generation has slowed down in the private sector, which accounts for 80 per cent of the urban jobs. Several sectors including manufacturing, consumer goods industry, software and information technology services are known to have reduced their hiring process.

"China was the darling of all investors till a few months ago and companies were willing to set up shop in the country. Things have taken a sharp turn. Not only have investors and companies understood the importance of diversifying the supply sources but the political aggression has also been unsettling," a mid sized exporter with a manufacturing facility in China said.

China has also drawn global attention in the last few months for its political, economic and military aggression in the region.

Ma and his problems

The Ant Group, formerly known as Ant Financial and an affiliate company of Alibaba, was hoping to raise $34.4 billion. Ma, a vociferous critic of the Chinese government and the nature of financial regulations and a few other senior executives of the company were even summoned by the authorities. A month before his company was to hit the bourses, Ma openly spoke against the outdated supervision norms and financial regulation which were dampening innovation. He also said that Chinese banks operated with a "pawnshop mentality".

Ma's companies are currently under regulatory watch for alleged monopoly.

"Ma had been speaking his mind, criticizing the government. This kind of a reaction from the government was not unexpected. However this also leaves doubts in the minds of the investors. It simply leads to bad taste and especially when the world is trying to get out of the massive Covid 19 induced financial crisis," a company executive said.

The executive said that given a chance, investors will look at putting in money in other countries considered "safer" in terms of policy guidelines as well as political scenario.