In a further crackdown on tech billionaire Jack Ma, Chinese authorities have ordered an investigation into the processes leading up to Ant Group's launching of the listing process. Jack Ma has been in the eye of a storm ever since he criticized Chinese President Xi Jinping and questioned the regulatory practices in the country last week.

The retaliatory moves against Jack Ma included a multi-billion dollar fine on Alibaba, which was slapped earlier this month. Ma had also gone 'missing' from the public view as Chinese regulators launched a raid and further probe into Alibaba ant Ant Group. There have been speculations that China has been trying to the business empire Ma built up over the decades. As per the latest reports, there are talks in China's top echelons of at least forcing the tech tycoon out of his businesses.

Regulators Launch New Probe

According to a report by Bloomberg, the Chinese regulators are now probing process by which China's securities regulator approved Ant Group's public offering, which would have been the biggest IPO offering in China had it gone ahead.

Citing sources who are not identified, the report says that the authorities are trying to find out if Ant's IPO was fast-tracked, and if the company made sufficient disclosures.

Beijing is also checking if Jack Ma and Ant Group got undue support from local officials, the Wall Street Journal had reported earlier. The inquiry also focuses on possible gains made by Chinese state-owned firms from the listing of Jack Ma's financial technology behemoth.

Criticism of China's Regulatory Practices

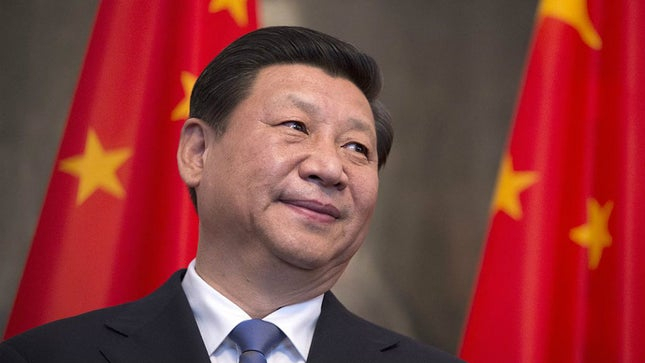

The Chinese antitrust investigators opened probe into Jack Ma's companies in late last year, triggering rumors that the tech wizard was being hounded. Ma's mifortunes started waning after he criticized President Xi Jinping's regulatory policies last year. Xi Jinping had said in October that the plan was to make China a more state-controlled economy based on domestic demand. Ma had obliquely criticized the move, drawing ire from the top echelons of the party-led government.

By the end of December last year, there were reports that the Chinese government was planning to nationalize Alibaba, Jack Ma's flagship company, as well as Ant Group.

In February, the WSJ reported that the Chinese Communist Party decided to block the initial public offering of the company as Xi believed that the IPO of Jack Ma's Ant Group would have a host of unwelcome beneficiaries besides adding stress to the financial system.

A report in March had said that the CCP government has been pressuring Alibaba Group Holding Ltd. to sell some of its media assets, including the South China Morning Post published from Hong Kong.

Jack Ma's Sprawling Portfolio of Media Assets

Jack Ma built a sprawling portfolio of media assets in the last few years. This included online outlets, newspapers, television-production companies, social-media and advertising assets. Among media companies that Alibaba has major stake are Weibo and SCMP.

Another report earlier this month said Ant Group was exploring options for founder Jack Ma to divest his stake in the financial technology giant and give up control. The report said that meetings with Chinese regulators signaled to the company that the move could help draw a line under Beijing's scrutiny of its business.

Officials from the central bank, People's Bank of China (PBOC), and financial regulator China Banking and Insurance Regulatory Commission (CBIRC) held talks between January and March with Ma and Ant separately, where the possibility of the tycoon's exit from the company was discussed, Reuters reported.

Now, even as the future and valuation of the sprawling tech giant is engulfed by uncertainty,

Ant Chairman Eric Jing told the staff that the company would eventually go public.