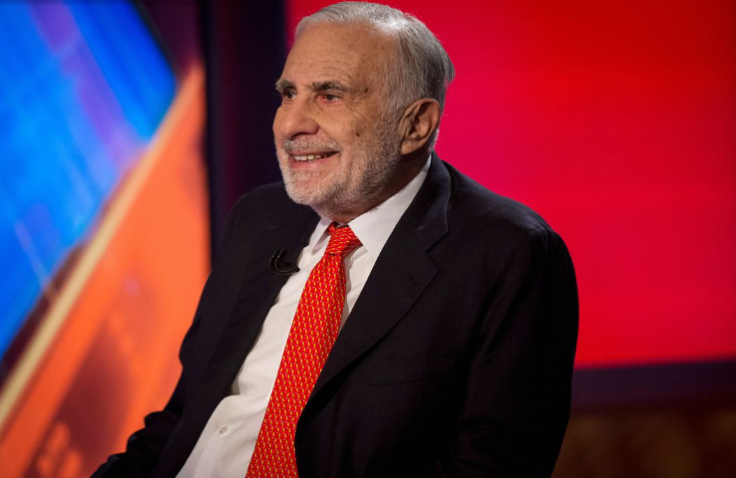

Activist investor Carl Icahn made a huge profit by investing in Twitter stock when it nosedived after Elon Musk's takeover bid ran into trouble. As it turned out, Icahn's daring call proved right, and the maverick is laughing all the way to the bank.

According to the Wall Street Journal, Icahn made a profit of at least $250 million from his investment in Twitter shares in the recent months. He pumped as much as $500 million intothe stock after troubles emerged following Musk's bid.

Purchased 14 Million Shares of Twitter

According to WSJ's estimates, Icahn purchased around 14 million shares of Twitter, which amounts to close to 2 percent of the company. He bought the shares in the mid-$30s range, calculating that Twitter's long-term average price would not go below that level.

In a surprise turn of events, Musk announced on Tuesday that he was reversing course on the Twitter deal and was willing to buy the company at the previously agreed price of $44 billion, which valued each share of the company at $54.20.

Twitter Shares Zoom 22% in a Day

Twitter shares zoomed as much as 22 percent on the news to close at $52. Icahn's gains from investing in Twitter at the dip turned out to be a massive $250 million. According to the paper's calculations, Icahn's stake was worth about $750 million, assuming that he has not sold the stake yet.

The report says that Icahn correctly called Musk's bluff as the billionaire investor concluded that Musk was unlikely to push ahead with the legal battle, which was most likely to lose.

In a letter written by Musk's lawyers, Musk said he is willing to go ahead with the deal under which each share of Titter is valued at $54.20. He said the intention is to complete the transaction, pending receipt of the financing and a formal end of the legal fight. The Twitter management said it was in receipt of Musk's offer, and that the company plans to "close the transaction at $54.20 per share."

Sudden Turn by Musk

Musk's offer came just days ahead of the lawsuit filed against him by Twitter board goes into trial. The trial is scheduled to start on October 17 in the Court of Chancery in Georgetown, Delaware. The case was filed after Musk sought to abandon his deal to acquire Twitter over what he says is a misrepresentation of fake accounts on the site.

The San Francisco-based company has been trying to force Musk to follow through on the deal and accuses him of sabotaging it because it no longer served his interests. Musk withdrew from the Twitter deal, which he had signed in late April, citing discrepancies in data regarding fake accounts on the platform.