Nvidia Corp had a tantalizing tryst with the trillion-dollar market cap landmark on Tuesday when its share prices saw another surge thanks to the AI frenzy that has hit the US stock markets.

On Tuesday, Nvdia shares climbed another 3 percent, marking a mind-blowing 200 percent surge since October last year. The market capitalization of the darling of the investors went past the $1 trillion valuation mark but edged lower to settle at $401.11

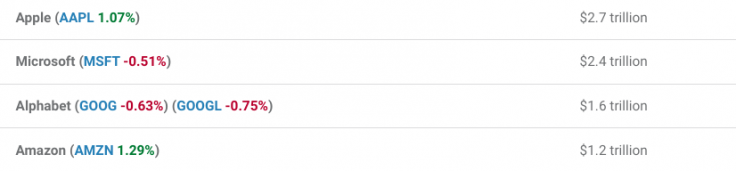

Nvdia shares have tripled in price in the last eight months, driven by the keen appetite for stocks that have a bearing on the booming artificial intelligence industry. The chipmaker was predicted to join the elite club of trillion-dollar companies like Apple, Microsoft, Amazon and Alphabet.

"We view Nvidia as the most important company on the planet in an era that is rapidly changing towards one that will be emphasized by greater AI capabilities," CFRA Research analyst Angelo Zino told Reuters News.

On Monday, Nvidia Corp said it would manufacture an array of highly advanced AI products including a new supercomputer.

"We're now at the tipping point of a new computing era with accelerated computing and AI that's been embraced by almost every computing and cloud company in the world ... It will give nonplayable characters conversational skills so they can respond to questions with lifelike personalities that evolve," said Nvidia CEO Jensen Huang.

Huang, who founded Nvidia in 1993, said among the new products in the pipeline is a large memory AI supercomputer platform known as DGX GH200. This platform is instrumental for developers who work on building big language models for AI chatbots. According to Nvidia, the DGX GH200 platform can be used as a blueprint for future hyperscale generative AI infrastructure.

Bullish sentiments over the beneficial impact of artificial intelligence tools like ChatGPT on businesses has given the US stock market a rare push this year. According to reports earlier this month, the rally in several key stocks helped the S&P 500 index gain as much as 9 percent so far this year. This was mainly driven by optimism that new technologies will increase the profitability of corporates.