The Russian rouble has staged a stupendous recovery, trading at 83.3 to the US dollar on Wednesday, after hitting an all-time low of 139 against the greenback on March 7. This was roughly the level the Russian currency was trading at when the Ukraine invasion began. Two weeks into the war, the rouble faced a historic rout, losing 40 percent and looked ever so brittle.

Now, a month after the debacle, which was interpreted as an ominous sign of the collapse of the Russian economy, rouble has found its mooring. Analysts do not discount the rouble's surge as a temporary bounce back as data shows the recovery was sustained and stable. In the process of the recovery, rouble also became the world's top performing currency in March.

How did this happen despite the crippling sanctions the US and its European allies imposed on Russia?

Sanctions Failed to Stop Foreign Currency Inflows

The primary reason is that the sanctions did not actually succeed in blocking significant foreign currency inflows into Russia.

Despite the sanctions, many European countries went ahead and bought Russian gas, helping Moscow garner critical inflows of dollars and euros while battling the sanctions. This was possible because the European buyers were not able to find immediate replacement for Russian energy.

Russian President Vladimir Putin refused to cave in when the West rolled out the tough sanctions. Russia continued to insist that oil and gas buyers in Europe must pay back in roubles. While the Europeans had no alternative energy supplies, they now had to go and find roubles, not dollars as usual, to buy their natural gas from Moscow. This drove up the demand for rouble, blostering the currency immediately.

US Treasury's Help

Secondly, Russia was able to fend off a credit default WITHOUT selling roubles to raise the dollars needed for the settling of interest payments. This was possible because the US Treasury really did allow financial intermediaries to settle Russian interest payments.

The US had frozen foreign currency reserves held by the Russian central bank at U.S. financial institutions as part of the sanctions imposed on Moscow after the Ukraine war started. However, the Treasury Department had allowed the Russian government to use the funds to make coupon payments on dollar-denominated sovereign debt on a case-by-case basis. This helped Russia prevent an additional drain on rouble while staving off default, thereby effectively helping the currency come back to health.

Support From Asian Friends

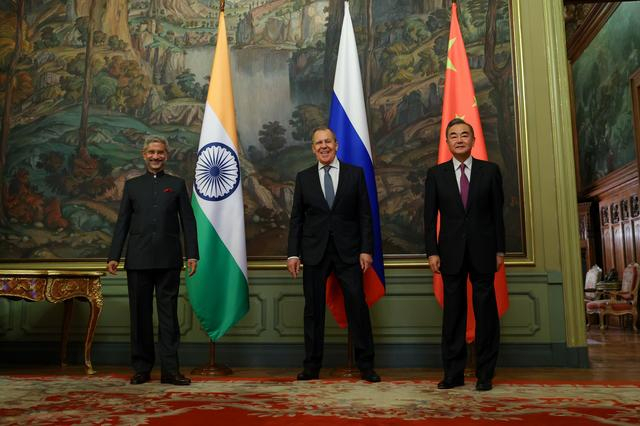

Thirdly, Russia's Asian friends espoused a remarkably different approach to the European crisis that started with Russia's invasion of Ukraine. While the United States and Western Europe adopted an extremely hostile stance against Moscow, the treatment in other world capitals like New Delhi and Beijing was quite different. The Asian allies made sure the West would not succeed in the game of arm-twisting. India and China pressed ahead with the purchase of the Russian oil, now cheaper for that matter.

Remarkably, India fended off naive yet feeble US threats about sanctions by affirming its position that it will not kill the S-400 missile defense purchase from Russia. Weeks into the war and intermittent threats on sanctions, now the US has all but acknowledged that India's purchase of S-400 would not be impacted by the sanctions. Such resolute support from key allies punched holes in the West's plot line of an imminent Russian collapse.

Raising Interest Rates

In the aftermath of the war and the sanctions, Russian President Vladimir Putin moved swiftly to tie up the lose ends at home. As the sanctions began to bite and the rouble started experiencing the pressure, Russian Central Bank of Russia raised interest rates to 20 percent. This shored up the battling currency's health immediately, as Russians found an incentive in saving up their roubles, thereby preventing a flight that would have made matters quickly worse.

Putin Ordered Russian Companies to 80% Foreign Earnings into Roubles

Another master stroke by Putin was the order that bound Russian companies to convert up to 80 percent of their earnings abroad into roubles. This meant that each time Russian companies received payments in dollars or euros abroad, a vast chunk of this was swapped into roubles, the NPR reported.

Ban on Money Transfer Abroad

Another key move that shored up the rouble was the ban on Russians transferring money abroad.By suspending all foreign exchange loans and transfers in the immediate aftermath of the war, Moscow prevented an additional pressure on the currency.