When the market enters bear territory, what should you do? Some investors hold on. Others invest more. And some decide to sell everything. There is a better option in mutual funds that seek to generate consistent returns in both bull and bear markets...

Funds that get beyond just stocks and bonds that are both suffering have been able to benefit from real diversification in both this bear market and previous recessions. The Nobel Prize laureate, economist Harry Markowitz is reported to have said, "Diversification is the only free lunch" in investing. However, most investors get the concept of diversification all wrong. If you own 500 stocks and the S&P 500 is down a lot, you are still going to be down a lot. The way to actually benefit from diversification is when you diversify your sources of risk rather than just owning many securities that are all exposed to the same risk factor.

Even though investors in financial assets like stocks and bonds are down this year, that isn't the case for many investors in "real assets." Investors that seek to benefit from inflation in oil, natural gas, and food prices are doing well this year.

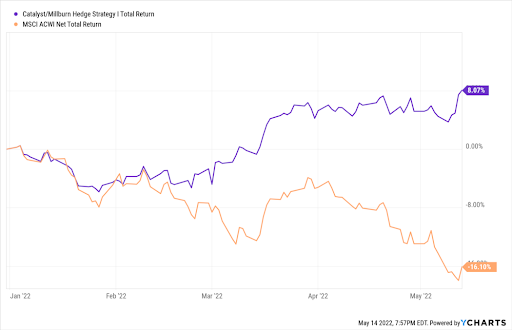

One of these funds that aims for risk mitigation through real diversification is the Catalyst Millburn Hedge Strategy Fund (ticker MBXIX). The fund seeks to generate consistent returns by truly diversifying its positions in precious metals, commodities, equities, interest rates, and currencies. The results speak for themselves.

Federal Reserve Chair Jerome Powell says inflation will cause some "pain" in the markets. Most people I know have been feeling some real pain the past few months. However, investors in this fund have been pretty happy.

There is something pretty special about a fund that rather than experiencing pain in the market this year is actually thriving. Especially when that fund is benefiting from inflation rather than taking a hit.

The Catalyst/Millburn Hedge Strategy Fund (NASDAQ:MBXIX) is having a very good 2022 outperforming the S&P 500 by 22.64% with a 4.14% return versus -18.5%.

Catalyst/Millburn Hedge Strategy Fund was launched on January 1st, 1997, and has generated an annualized return of 10.8% since inception which rivals the return of the S&P 500 over that same period by over 100 basis points. MBXIX employs a hybrid equity/futures strategy designed to outperform a typical long-only equity investment strategy over a full cycle and historically has generated positive results during previous equity bear markets.

The most distinctive achievement of the fund is that it both outperformed the S&P since inception while generating positive performance in equity bear markets like 2000, 2001, 2002, 2008, and 2022. The fund has maintained double digit annualized returns since inception without a single double digit negative calendar year.

In order to properly manage its portfolio, MBXIX uses a 100% systematic strategy driven by machine learning. Specifically, the portfolio consists of an active long/short futures & forex component mixed with a strategic equity exposure component. One of the keys to the long-term success of the fund is its ability to invest in agricultural commodities, forex, metals and energy.

Typically, these types of alternative investments in managed futures have a tendency towards negative correlation with traditional investments like stocks and bonds during periods of crisis. This explains why MBXIX has the ability to perform well in both bull markets and bear markets. The fund has proven its ability to perform particularly well in prolonged bear markets. For example, following the internet mania of the late-1990s, the S&P 500 declined for three consecutive years from 2000 through 2002. The combined loss was (43.09%).

During the same time period, MBXIX generated a positive rate of return of 21.83%. The global financial crisis in 2008–09 was another difficult time for equity investors.

The S&P 500 recorded a brutal decline of (37.00%) in 2008. This marked the worst annual slump in the stock market since 1937. Despite the fact that a financial crisis was causing historic declines in global equity markets, MBXIX produced a return of 5.33% in 2008, substantially outperforming the S&P 500.

In addition to performing exceptionally well in bear markets, MBXIX has achieved impressive results in bull markets. Several significant rallies have unfolded during the past two decades. Examples include 1998, 2009, 2017 and 2019. The average annual rate of return during this period of time was 14.14% for Catalyst Millburn.

The uncorrelated nature of the strategy has enabled it to generate strong positive returns in both bull and bear markets. An important characteristic of a successful investment vehicle is the ability to achieve consistent performance results.

MBXIX has produced very consistent results throughout its trading history. The fund has yielded only three single digit losing years despite the fact that equity markets have endured several brutal drawdowns since 1997.

Even more impressive is the fund's performance over a 5-year rolling period. MBXIX has never recorded unprofitable results over any 5-year rolling period since its inception in 1997. One of the highest honors any mutual fund can achieve is a top decile ranking from Morningstar. MBXIX is rated top decile of its category over the past 5 years on risk-adjusted returns in Morningstar's macro trading strategy category.

Navigating The Future Investment Landscape

Nobody has a crystal ball. It's impossible to forecast the future direction of financial markets. However, based on G20 central banks' aggressive monetary policy following the global pandemic, it's probably safe to assume that several asset classes could experience a fair amount of volatility during the next several years. Of course, volatility provides opportunity for those who are properly positioned to capitalize on it.

In 2001, commodities entered a new secular bull market. The first phase of the bull market ended in April 2011. The second phase began in March 2020 with a new cyclical bull market, precisely when G20 central banks introduced aggressive money printing programs in response to the global pandemic. Typically, secular commodity bull markets will continue for 30 to 40 years. Therefore, the current bull market in commodities is likely to persist for the remainder of this decade.

Unlike many mutual funds, MBXIX could potentially benefit from the bull market in commodities based on the fact that the fund has direct exposure to this asset class. Investors with a 60/40 portfolio or long-only equity portfolio may want to consider allocating a percentage of their investment dollars into a mutual fund like MBXIX.

Catalyst Millburn is clearly not another typical boring mutual fund with a handful of stocks held inside. Instead, MBXIX provides its investors with exposure to over 125 different markets, thus creating a level of diversification not found in most mutual funds. Based on its impressive performance results and exposure to multiple asset classes, investors should seriously consider adding MBXIX to their portfolio.