Donald Trump reportedly owes tens of millions of dollars to a state-owned bank in China owing to a real estate loan which is due in a few years, giving Beijing significant leverage over the US President.

In 2012, Trump's real estate business refinanced one of Trump's most prized possessions, his 43-story tower in Manhattan, New York City, for nearly $1 billion. $211 million of the loan came from the state-owned Bank of China and matures in the middle of what could be Trump's second term if he is re-elected as the US President, according to Politico.

Trump's debt to a Bank of China

Trump owns a 30 percent stake in the Manhattan property, making it one of the most expensive assets in his portfolio, according to his financial disclosures. Trump's ownership of the building received a dash of attention before and after his 2016 campaign. However, his arrangement with the Bank of China, and its impending due date in 2022 had gone largely unnoticed.

Can it hurt Trump's re-election campaign?

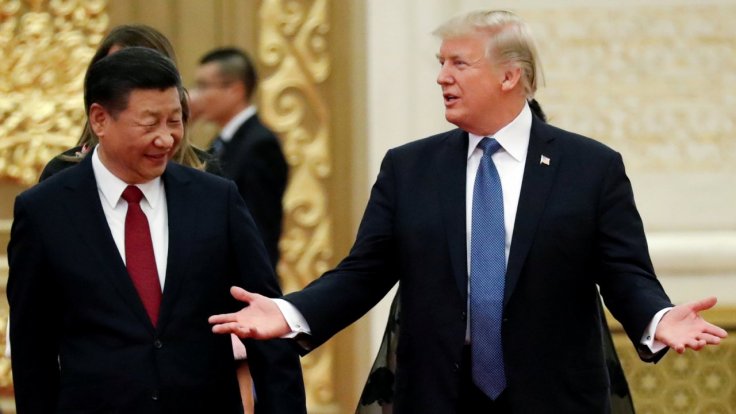

The debt owed to Bank of China could complicate things for Trump in his re-election campaign as his strategy has mainly focused on portraying his Democratic opponent, Joe Biden, as being soft on China, amid growing criticism over Trump's handling of the coronavirus pandemic and new opinion polls showing him trailing behind the former Vice President. In a briefing on Saturday, Trump said "China will own the United States" if Biden was elected in November.

Apart from the idea of a developer-turned president paying back millions of dollars to a bank controlled by a foreign government, the 2012 Bank of China loan will also draw attention because Trump and his campaign have repeatedly highlighted the same bank's role in a $1.5 billion deal announced in 2013 by partners of Biden's son, Hunter Biden.

Biden's critics have shed light on the fact that the deal was finalized just days after Hunter Biden travelled to China with his father. "Why did the Chinese government's bank want to do business with Hunter Biden while his dad was Vice President," Trump's campaign asked on Twitter earlier this month. The issue was also raised in a campaign ad the day before.

However, Trump's recent criticisms of China have been complicated by his own financial ties to the Xi Jinping-led country. These extend far beyond the Manhattan property loan: Chinese state-owned companies are constructing two luxury Trump properties in Dubai and Indonesia. Moreover, the President and his daughter, Ivanka Trump, a White House adviser, have been awarded trademarks by China's government and Trump's son-in-law, Jared Kushner has courted Chinese investors in at least one other real estate deal.

Conflict of interest

According to Isaac Stone Fish, a senior fellow at the Asia Society, Trump's deal with Bank of China is a huge problem for Trump and his re-election campaign. "I study Beijing's influence on America, and this is the most problematic conflict of interest I've seen," he wrote on a Twitter thread. "The Bank of China is a state-owned bank, controlled by China's State Council, the country's major administrative body, chaired by the Premier Li Keqiang."

"The leverage this presents is astonishing. What if the Bank of China cancels the loan, or requires Trump to pay it back earlier?" Fish asked. "Is this why Trump often praises Chinese Chairman Xi Jinping? Does this cause him to temper his policies or his public remarks? This raises so many questions."