WeWork, the one-time unicorn backed by SoftBank Group, known for its meteoric rise and subsequent fall that significantly impacted the global office industry, filed for Chapter 11 bankruptcy protection in a New Jersey federal court on Monday. This move came after its expectations for increased use of its shared office spaces by various companies soured.

The filing for bankruptcy protection, which was expected, is specific to WeWork's operations in the United States and Canada, despite the company having 777 locations worldwide, as per regulatory filings. The filing indicates that the company has reported liabilities spanning from $10 billion to $50 billion. WeWork shares have fallen around 98.5 percent this year.

No Work at We Work

The troubled company, previously valued at $47 billion in the private market, saw a staggering 98 percent decline in its share price this year, resulting in a market capitalization of less than $50 million.

In August, WeWork cast uncertainty over its ability to sustain operations as it faced $2.9 billion in net long-term debt and over $13 billion in long-term leases.

WeWork revealed it had engaged in a restructuring support agreement and planned to resolve the debt by addressing existing leases and significantly enhancing its financial position.

WeWork CEO David Tolley, who assumed the role after the previous CEO resigned in May, said: "I am deeply grateful for the support of our financial stakeholders as we work together to strengthen our capital structure and expedite this process through the Restructuring Support Agreement."

"We remain committed to investing in our products, services, and world-class team of employees to support our community."

Despite the impending bankruptcy filing, the company's leadership assured that the majority of WeWork spaces would continue to operate.

"WeWork spaces remain open and operational and we will continue to provide our members with the exceptional experience they have come to expect," WeWork's statement reads. "WeWork is here to stay and we plan to remain in the vast majority of buildings as we move into the future."

On Monday, as reports surfaced indicating WeWork's plan to file for bankruptcy, trading of WeWork shares was halted, with Wall Street anticipating this financial move.

Fall from Grace

The New York-based company, founded in 2010, first faced problems when it planned to go public in 2019. In August of that year, the company, known for leasing co-working spaces to freelancers, startups, and established firms, disclosed its complete financial details, exposing a $900 million loss in six months.

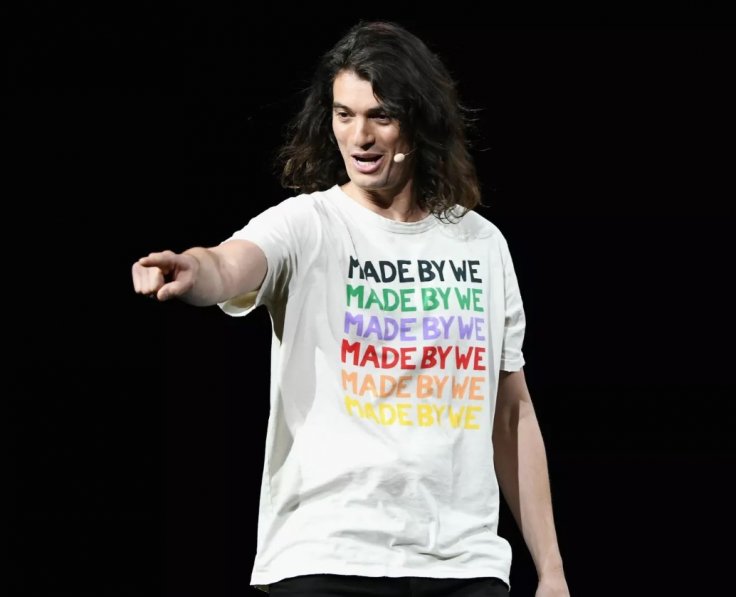

The initial public offering (IPO) was unsuccessful due to investor concerns regarding its business structure and management led by founder and then-CEO Adam Neumann. This resulted in a significant downturn for the company, causing its valuation to plunge to less than $10 billion.

Adam Neumann, the former CEO of WeWork, fell from grace and was eventually removed from his position amid allegations of fostering a toxic work environment within the company.

Despite WeWork's initial portrayal of an idealistic workplace, employees later revealed a different reality, describing it as having a 'cult-like' atmosphere. Neumann was dubbed the 'partyer in chief' due to his 'tequila-fueled leadership style,' which reportedly involved smoking marijuana on private jets.

Allegations of excessive behavior included Neumann hosting a three-day party for 8,000 employees to celebrate the company's soaring valuation.

According to Reeves Wiedeman's book, "Billion Dollar Loser: The Epic Rise and Fall of WeWork," Neumann insisted on having cases of Don Julio 1942 tequila in every office and was known to react strongly if they were not available.

Despite discontent among staff regarding low wages, Adam Neumann allegedly boasted about the minimal pay given to employees. He reportedly emphasized that staff members should rely on a 'sense of purpose' and the availability of free beer as compensation for their work, the book mentions.

In 2020, it was reported that the company paid over $2 million in cash to a female whistleblower to maintain her silence after she threatened to expose alleged incidents of drug use, intimate relations among colleagues and discrimination, and claimed to be a victim of a sexual assault within the company.

WeWork eventually went public in October 2021 through a merger with a special purpose acquisition company, yet the struggles persisted, resulting in a dramatic decline of 98 percent in its value.

The company informed regulators on August 8 that deteriorating macroeconomic conditions have amplified the decline in demand for its shared office spaces. It also cited challenges stemming from high turnover rates among its members.

Presently, WeWork accommodates 512,000 members in its workspaces across 33 countries. According to the company's website, there are currently 32 co-working locations in the United States.