The prospect of China overtaking the United States as the world's biggest economy has been discussed often in recent years, with more analysts predicting that it would happen in about a decade or so.

Just this last January, the British consultancy Centre for Economics and Business Research (CEBR) said China is on course to overtake the US as the No. 1-ranked economy by 2030. This huge economic and geopolitical landmark in modern history will become possible if China's GDP grows 5.7 percent per year in the next two years and then at 4.7 percent annually until 2030.

How do China and the US Stack Up?

As of 2020, the size of China's economy was $15.92 trillion, according to IHS Markit. The market research firm estimates that the Chinese economy expanded to $18 trillion a year later. This compares with the US economy, which reached about $23 trillion in 2021.

Slowing Growth, Rising Challenges

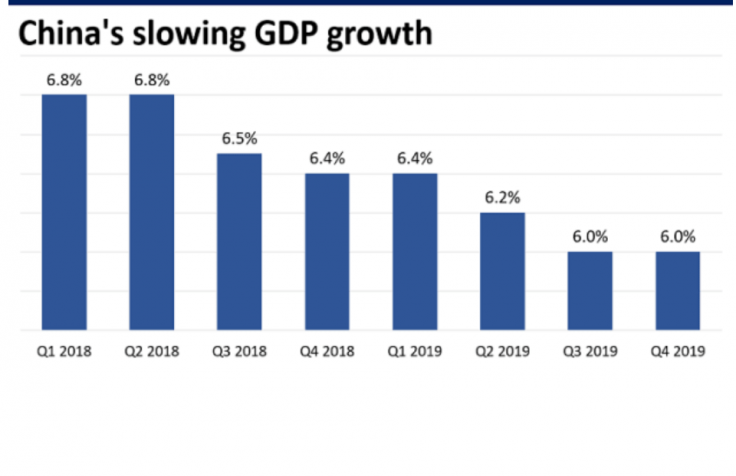

Data shows that the size of China's economy has more than doubled since 2010. Can China continue to record similar growth in the current scenario? The latest assessment of the Chinese economy raises doubt if it can sustain that level of growth. There is an overhang of doubt among economic analysts if China will, ever, overtake the US economy at all.

Zero-Covid Policy's Impact

China has set itself the goal of doubling GDP from 2020 levels by 2035, but this is tough to materialize due to certain clear factors. Primarily, the Covid-19 pandemic has dented such high hopes. China needs to retain a growth rate above 5 percent over the medium term to reach such goals, but this does not seem to be possible now. More than the pandemic, the zero-Covid policy in force at the moment is the main reason why the growth rate will remain muted.

Declining Income and Domestic Consumption

If the current Covid policy stays in place, China GDP growth will be pushed back to below 3 percent levels. The draconian zero-Covid policy is not just killing foreign investment but causes a decline in incomes, which in turn affects domestic consumption. An economy of China's size can't continue a fairy tale growth story without a substantial increase in domestic consumption.

Property Market Slowdown

Another factor is that China's housing market is still sagging, and it has the potential to thrwo nasty surprises. The unending boom in the housing market that China witnessed over the decades is all but gone. The specter of a housing market bust has been raised very often, and this is what China would want to never handle. The housing market slowdown has already resulted in a decline in investment. Continued stimulus may not work, as a more severe downturn might occur when the stimulus is invariably withdrawn.

"If the property downturn is deeper than expected and Covid Zero restrictions remain beyond 2023, GDP growth may average below 4% over the next decade, meaning China likely wouldn't overtake the US until the mid-2030s, and any lead may be reversed as demographics become a drag a decade later," Bloomberg Economics says in an analysis.

Population Decline

Then there is the demographic challenge. China surprised the world when it rolled back the one-child policy and offered incentives for parents with more children. Obviously, the population decline happened much earlier than expected in China. This has a direct bearing on the economy. Workforce size is important for an economy like China's, which at any point boasts of around 760 million workers.

Over the next decades or so, China will see strains occurring in the workforce capacity. One way to deal with it is to raise the retirement age. However, raising the retirement age to, say,65, as mostly in the West, is a difficult political call in China.

World's Factory? Competition is Rising

Other major roadblocks are the dwindling factory output, rising wages that make it a less preferred destination for multinational companies, the aggressive expansion of global investment in countries like India and Vietnam. China is no longer the go-to place for global multinationals who were looking to unlock efficiencies and tap cheap labor. India, Vietnam and other southeast nations are turning out to be attractive alternatives.

Taiwan Factor and Specter of Sanctions

And then there are geopolitical and strategic challenges. The US has already started crippling China's hi-tech industries by tightening controls over the semiconductor manufacturers. If the US rolls out stricter sanctions on China, on the lines of the Russia sanctions, the Chinese economy will receive a blow that it would find too tough to handle. Such a scenario is unlikely in the normal course, but the Taiwan factor remains risky precisely because of this. A Taiwan invasion by China will attract severe sanctions not just from the US but from its western allies. The economic blow back from that tsunami will take the Chinese growth story years behind.