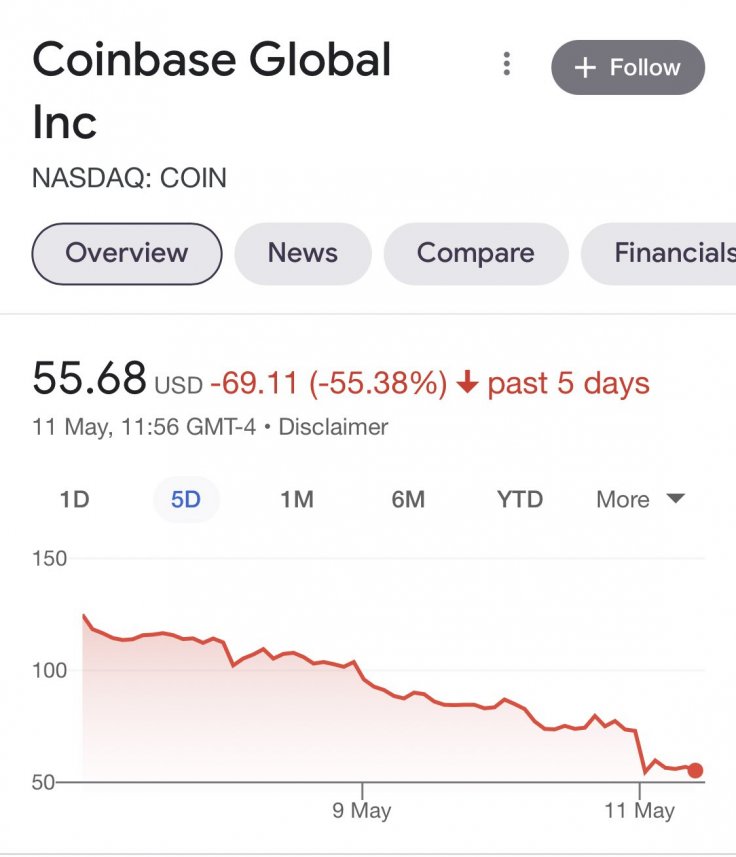

Coinbase shares have plunged to a record low as Bitcoin value is steadily falling. The cryptocurrency brokerage's shares fell nearly 25 percent in early trading on Wednesday as the company reported its first-quarter loss on late Tuesday.

Coinbase share plunged to $52.80 early on Wednesday. The company's revenue has fallen 27 percent from a year ago. It came as Bitcoin and Ethereum are witnessing a massive drop in their values.

Coinbase Claims These Conditions Aren't Permanent

The company received 48 percent of transaction revenue from Bitcoin and Ethereum in the quarter. Coinbase has said that the first quarter of 2022 continued a trend of both lower crypto asset prices and volatility that began in late 2021 and these market conditions directly impacted the firm's Q1 results.

The company stressed that it believes these market conditions are not permanent and the firm remains focused on the long-term.

"In fact, our investment in our business now is especially critical – these periods of low volatility can provide the opportunity to focus more intently on product development," said Coinbase in a letter to shareholders.

Customers Won't Be Able to Access Their Assets if Coinbase Goes Bankrupt

The company has alarmed its customers too as Coinbase has maintained that in the event of bankruptcy, the crypto assets it holds on behalf of the customers could be subject to bankruptcy proceedings and such customers could be treated as general unsecured creditors, according to CNN.

But the company's CEO Brian Armstrong has confirmed that customers' funds are safe in Coinbase and there is no possibility of bankruptcy.

"Your funds are safe at Coinbase, just as they've always been. We have no risk of bankruptcy, however, we included a new risk factor based on an SEC requirement called SAB 121, which is a newly required disclosure for public companies that hold crypto-assets for third parties," Armstrong said in a tweet.

But he apologized for not updating the terms for retail customers. Armstrong underlined that the company is updating user terms for retail customers to offer them protection in a black swan event. "We should have had these in place previously, so let me apologize for that."