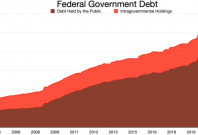

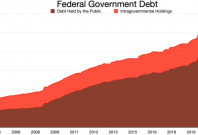

As per the Treasury the US government has run out of money to pay its bills and the Congress must pass a resolution that lifts the debt ceiling.

As per the Treasury the US government has run out of money to pay its bills and the Congress must pass a resolution that lifts the debt ceiling.

To put things in perspective, even as the Blackrock analysts made this comment, Federal Reserve policymakers said they will go for further rate tightening to control inflation.

To put things in perspective, even as the Blackrock analysts made this comment, Federal Reserve policymakers said they will go for further rate tightening to control inflation.

Some analysts say that China's emergence from a protracted Covid-19 lockdown and the positive sentiment this has stirred up are driving the greenback down.

Some analysts say that China's emergence from a protracted Covid-19 lockdown and the positive sentiment this has stirred up are driving the greenback down.

Trade between Russia and China hit a record high of $190 billion last year, Chinese customs data showed.

Trade between Russia and China hit a record high of $190 billion last year, Chinese customs data showed.

The full reopening of mainland China's borders is likely to be delayed until international restrictions against China-originated travel are dropped.

The full reopening of mainland China's borders is likely to be delayed until international restrictions against China-originated travel are dropped.

Analysts expect a sharp pick-up in consumption and investment in China from mid-2023 onwards.

Analysts expect a sharp pick-up in consumption and investment in China from mid-2023 onwards.

The US Federal Reserve increased benchmark interest rates by 50 basis points on Wednesday, bringing the US rates to the range of 4.25-4.50 percent.

The US Federal Reserve increased benchmark interest rates by 50 basis points on Wednesday, bringing the US rates to the range of 4.25-4.50 percent.

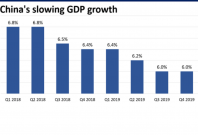

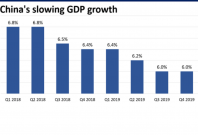

The Chinese economy's growth had decelerated to just 3 percent in the first three quarters of 2022, which is far below the targeted annual growth rate of around 5.5 percent.

The Chinese economy's growth had decelerated to just 3 percent in the first three quarters of 2022, which is far below the targeted annual growth rate of around 5.5 percent.

The minutes of the policymakers' meeting earlier this month showed that a 'substantial majority' of policymakers thought it was now okay to reduce the pace of the rate hike.

The minutes of the policymakers' meeting earlier this month showed that a 'substantial majority' of policymakers thought it was now okay to reduce the pace of the rate hike.

The Amazon founder advises consumers to keep their cash safe and avoid unnecessary spending.

The Amazon founder advises consumers to keep their cash safe and avoid unnecessary spending.

The inflation picture has become more and more challenging over the course of this year, says Federal Reserve Chairman Jerome Powell.

The inflation picture has become more and more challenging over the course of this year, says Federal Reserve Chairman Jerome Powell.

Hong Kong's economic contraction was the deepest since the Q2 numbers of 2020 showed the GDP product shrank 9.4 percent.

Hong Kong's economic contraction was the deepest since the Q2 numbers of 2020 showed the GDP product shrank 9.4 percent.

The US economy had shrunk as much as 1.6 percent and 0.6 percent in the first and second quarters of the year.

The US economy had shrunk as much as 1.6 percent and 0.6 percent in the first and second quarters of the year.

Real estate analysts tell Radio Free Asia that rich people are selling off properties in cities like Shanghai, Wuhan, Beijing, Jiangsu and Zhejiang.

Real estate analysts tell Radio Free Asia that rich people are selling off properties in cities like Shanghai, Wuhan, Beijing, Jiangsu and Zhejiang.

Data showed that Singapore's economy expanded an impressive 4.4 percent on a year-on-year in the third quarter.

Data showed that Singapore's economy expanded an impressive 4.4 percent on a year-on-year in the third quarter.